The smart Trick of Investment Representative That Nobody is Talking About

Table of ContentsIndependent Financial Advisor copyright Fundamentals ExplainedThe Ultimate Guide To Private Wealth Management copyrightGetting The Independent Financial Advisor copyright To WorkThe Definitive Guide to Investment RepresentativeRetirement Planning copyright Things To Know Before You Get ThisGetting My Ia Wealth Management To Work

“If you're purchase a product or service, say a tv or a computer, you'd wish to know the requirements of itwhat tend to be its parts and exactly what it can do,” Purda explains. “You can consider buying monetary guidance and support just as. Individuals have to know what they are getting.” With economic advice, it’s crucial that you remember that the merchandise isn’t ties, stocks or other financial investments.it is things like budgeting, planning pension or paying off personal debt. And like purchasing some type of computer from a reliable business, consumers would like to know they are purchasing monetary guidance from a reliable expert. One of Purda and Ashworth’s most interesting conclusions is about the charges that financial coordinators cost their clients.

This presented correct irrespective of the fee structurehourly, payment, possessions under administration or flat rate (within the learn, the buck value of costs was exactly the same in each instance). “It however comes down to the worth proposal and anxiety in the customers’ component that they don’t know very well what they've been getting back in change of these costs,” claims Purda.

An Unbiased View of Independent Investment Advisor copyright

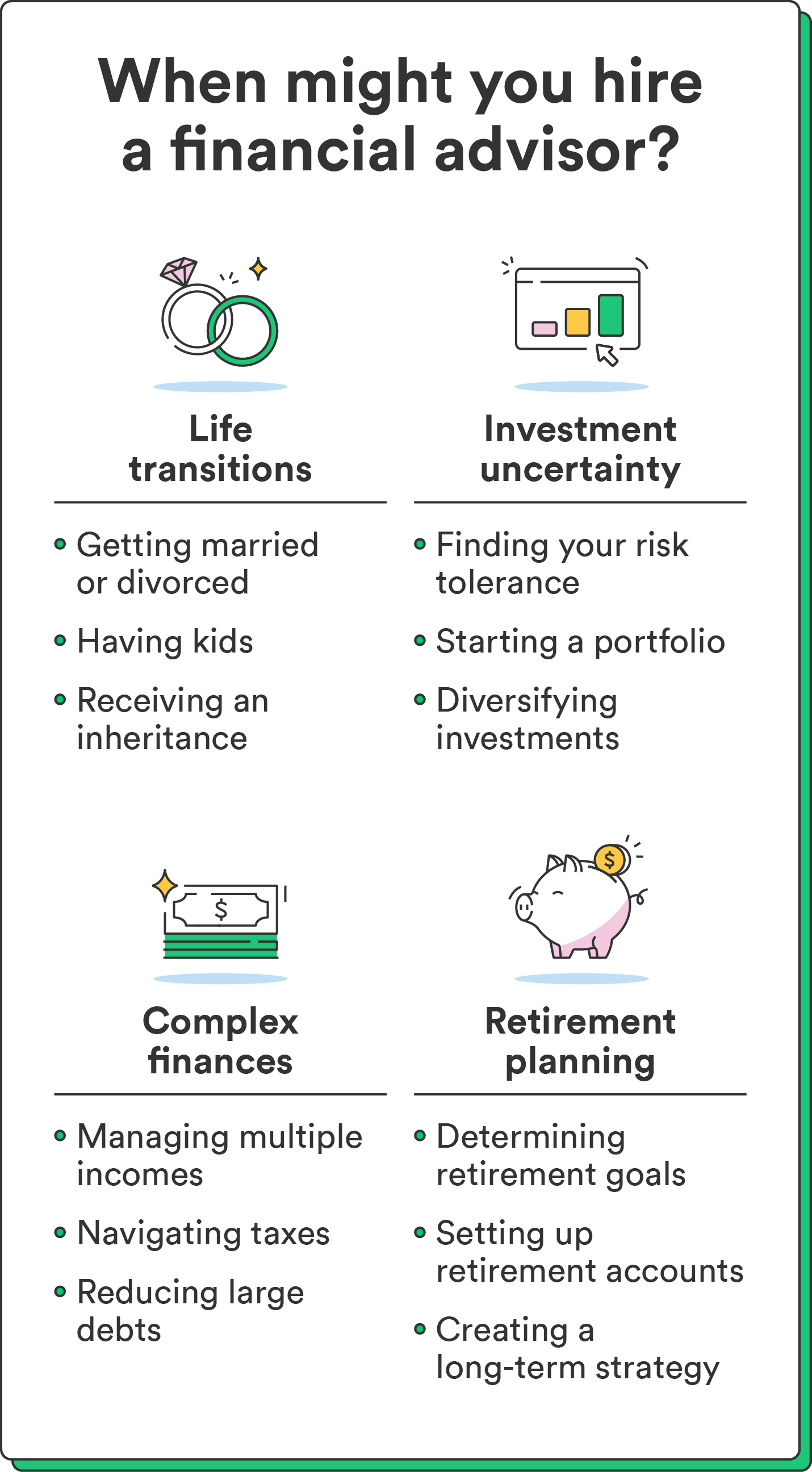

Tune in to this information as soon as you listen to the definition of economic consultant, just what pops into their heads? Many people remember a professional who can give them financial guidance, particularly when it comes to trading. That’s the place to begin, but it doesn’t paint the total photo. Not even close! Monetary analysts will people with a number of other money goals too.

An economic advisor will allow you to develop wide range and protect it when it comes down to long term. They are able to estimate your personal future monetary needs and plan strategies to stretch the pension cost savings. They may be able in addition help you on when you should start experiencing Social protection and utilizing money inside your retirement reports to abstain from any terrible penalties.

Independent Investment Advisor copyright - An Overview

They are able to allow you to ascertain exactly what shared resources are best for your needs and show you how to helpful resources handle and then make the most of your own investments. They may be able additionally help you comprehend the risks and what you’ll should do to get your aims. An experienced investment expert will help you remain on the roller coaster of investingeven whenever your financial investments just take a dive.

They are able to give you the direction you need to generate a plan in order to make sure your wishes are performed. While can’t put an amount tag in the assurance that include that. Based on research conducted recently, the average 65-year-old couple in 2022 needs about $315,000 conserved to pay for medical care prices in retirement.

The Basic Principles Of Investment Consultant

Given that we’ve gone over what economic advisors carry out, let’s dig in to the kinds of. Here’s a beneficial principle: All monetary coordinators tend to be financial experts, but not all experts tend to be planners - https://www.anyflip.com/homepage/megji. A financial planner concentrates on helping people make intentions to reach long-term goalsthings like starting a college investment or conserving for a down repayment on a house

So how do you understand which financial specialist is right for you - https://www.artstation.com/user-5327267/profile? Here are some actions you can take to ensure you’re choosing suitable person. What do you do when you've got two terrible options to pick from? Simple! Get A Hold Of a lot more solutions. The greater options you really have, the much more likely you happen to be to manufacture a beneficial decision

The Facts About Ia Wealth Management Uncovered

Our very own wise, Vestor system causes it to be easy for you by showing you as much as five financial experts who is going to last. The good thing is, it's totally free to have connected with an advisor! And don’t forget to get to the interview ready with a list of concerns to inquire about so you can find out if they’re a great fit.

But tune in, because a specialist is actually wiser than the average keep does not let them have the right to let you know what you should do. Often, analysts are full of by themselves because they convey more levels than a thermometer. If an advisor begins talking down for you, it is for you personally to demonstrate to them the entranceway.

Just remember that ,! It’s essential along with your economic advisor (whoever it ultimately ends up getting) are on similar page. You prefer a specialist that has a long-term investing strategysomeone who’ll motivate one hold investing constantly if the market is upwards or down. tax planning copyright. Additionally you don’t wish work with someone who forces one to put money into something which’s as well risky or you are uncomfortable with

Our Retirement Planning copyright Diaries

That mix provides you with the diversification you will need to successfully spend for the long haul. While you study financial analysts, you’ll most likely encounter the word fiduciary obligation. All this work suggests is any specialist you hire must work such that benefits their own client and not their own self-interest.